We publish a chart every other week that captures an interesting data or talking point within the broader Communications Infrastructure and Cable, Satellite, and Telecom Services sectors. This week, we are highlighting the annual network OpEx cost differential between legacy hybrid fiber-coaxial (HFC) networks and FTTH networks.

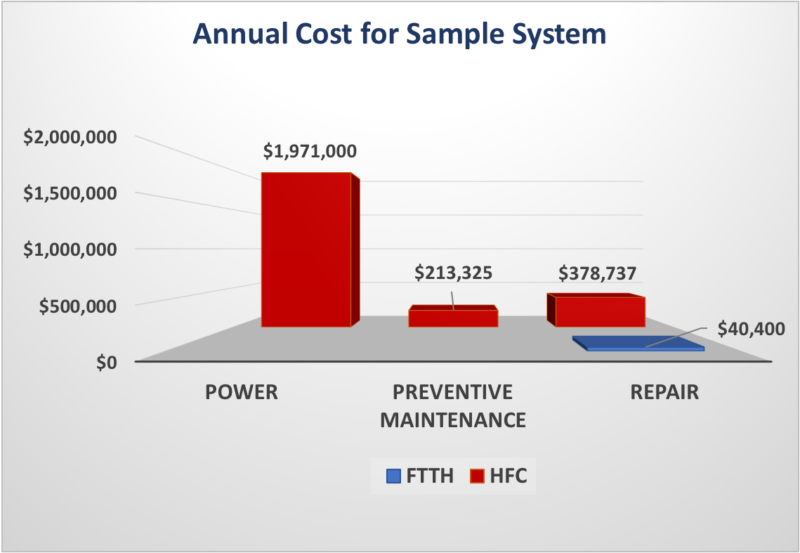

Note: The above study was conducted with a sample of 100,000 homes in a suburban neighborhood with density of ~60-90 homes per mile. Costs above only include plant operations and do not include customer repair calls. Source: Broadband Success Partners

During our 7th Annual Cowen Communications Infrastructure Summit earlier this week, we held a workshop with consulting firm Broadband Success Partners (BSP) detailing the case for FTTx, including the network topology and power and maintenance needs among other aspects, of which perhaps the most interesting takeaway was the meaningful network OpEx savings that can be achieved with FTTH when compared to HFC.

In the above chart, BSP summarizes the results of a sample study of 100,000 homes located in a suburban neighborhood with density of ~60-90 homes per mile. In the study, they looked at the annual network-related costs required to run an HFC plant vs. a FTTH plant, including costs for power, preventive maintenance, and repair. In HFC networks, power made up the vast majority of the annual network OpEx (~$2MM), with preventive maintenance (~$200K) and repair (~$400K) being far less.

Conversely, in FTTH networks, the only network OpEx cost was ~$40K for repair (for the occasional fiber break/fixes). With regards to power costs (including electricity, batteries, and battery maintenance), HFC networks have significant ongoing power expenses including electric utility payments and maintaining power supply to batteries while FTTH networks have no power needs as PONs are by definition “passive”, with optical line terminals (OLT) typically in the head-end (HE) feeding the outside plant, with little/no need for active electronics, and fewer “moving parts” in the field.

Furthermore, given HFC networks must monitor for signal leakage, water intrusion, corrosion, and ongoing proof of performance, they carry higher preventive maintenance costs relative to FTTH plants that require no routine or preventive maintenance, thus saving another ~$200K per annum, according to Broadband Success Partners. Finally, on repair costs, the sample study shows HFC networks requiring ~ $400K per annum in repairs, while the FTTH sample costs just over $40K, again highlighting the durability of FTTH infrastructure.

All said, once installed, a fiber network requires less equipment (removing hubs, taps, and amplifiers through the network), no field power requirements, no routine maintenance, no signal leakage measurement or remediation, and has no fear of corrosion with metallic connectors the way a HFC network would. As such, Fiber networks can save operators ~$2.5MM per 100K homes per annum in network OpEx costs, on average.

Furthermore, in addition to this study, FTTH can drive meaningful savings on non-network OpEx as we’ve noted a potential for a 30-40% lower incident rate (fewer service calls, fewer outages, faster repair times, fewer truck rolls) that can drive an overall OpEx savings of 30-40% (we’ve heard as high as 50%). To that point, Altice claims that their entire ~5MM HHP FTTH business case is justified from the OpEx savings alone (no ARPU or churn benefits needed) with a payback in “only a few years”.

Source: “Chart of the Week” by Colby Synesael, Cowen Equity Research, August 13, 2021

.